There were high emotions at a benefit concert staged by Ariana Grande in Manchester less than two weeks after the terror attack following her gig in the city. But the show also demonstrated the power of pop music to bring people together.

Several viewers took to social media to highlight the moment a policeman was seen dancing with young fans as a symbol of the city’s unity.

The concert was watched by an average of 10.9 million viewers, peaking at 14.5 million as the gig drew to a close – making it the most watched TV show of the year so far.

Here are some of the night’s other most powerful moments.

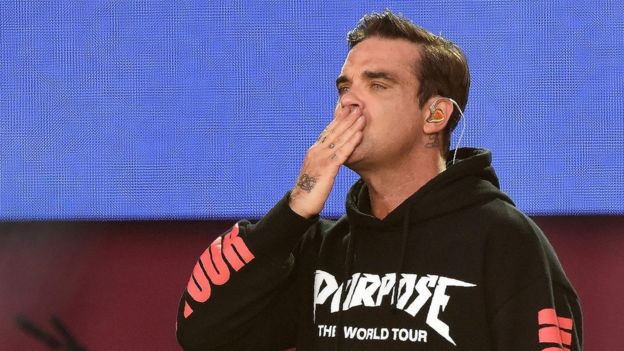

Strong – Robbie Williams

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER“Manchester, we’re strong, we’re strong, we’re strong/We’re still singing our song, our song, our song.” – Robbie Williams, Strong (2017 version)

With a few tweaks to the chorus, Robbie has turned a minor 1998 hit into a rousing song to rally the masses in Manchester 2017.

Everyone in the crowd could easily bellow the simple chorus, and Robbie bellowed it in between songs too.

It even overshadowed his classic Angels as his main sing-a-long moment.

Wings – Little Mix

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER“No matter what you say it won’t hurt me/Don’t matter if I fall from the sky/These wings are made to fly.” – Little Mix, Wings

Little Mix induced some of the most piercing screams of the night.

The girl group explained that Wings is about encouraging people to “stand together and not let anything bring them down” – but their performance was the biggest slice of pure, escapist, plastic pop we had.

So it was also the epitome of one aspect of what tonight was all about – defending the right to gyrate in PVC pants and conjure cliche-ridden fantasies, and for fans to lap up every second of it.

My Everything – Parrs Wood High School Choir and Ariana Grande

“If I go tomorrow, just know I’m yours/’Cause what we got is worth fighting for.” – Ariana Grande, My Everything

Rubbing shoulders with the pop superstars were 26 students from Parrs Wood High School Choir in Manchester, who performed a tear-jerking rendition of Grande’s My Everything.

They were invited to perform after putting their version of the track on YouTube in tribute to those who died in the attack.

Angel-voiced soloist Natasha Seth, 12, was joined by Grande herself, who held the girl’s hand – then, as the emotion became too much for the youngster, put her arm around her shoulder and squeezed her tight.

Part of Me – Katy Perry

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER“Throw your sticks and your stones, throw your bombs and your blows/But you’re not gonna break my soul.” – Katy Perry, Part of Me

Of all the performers, Katy Perry captured the mood of defiance and strength the best.

Wearing a white feathered gown, she started by telling the crowd: “Love conquers fear and love conquers hate and this love that you choose will give you strength, and it’s our greatest power.”

Part of Me hit exactly the right tone – reflective and empowering – before she unleashed her full-throated anthem of defiance, Roar.

Where Is The Love? – Black Eyed Peas and Ariana Grande

“Overseas, yeah, we try to stop terrorism/But we still got terrorists here livin'” – Black Eyed Peas, Where Is The Love?

Almost 15 years after it was a mega hit, this song still sums up the incomprehension most people feel at the brutal ruthlessness of the modern world, while offering hope that it doesn’t have to be this way.

Ariana joined on vocals and there was a real moment when the band encouraged fans to raise a finger to represent “one love” and make heart shapes with their hands.

Will.i.am did arrive on stage saying “Whassup London!” – but he just about got away with it by paying tribute to the capital as well as Manchester.

Don’t Look Back in Anger – Coldplay and Ariana Grande

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER“Don’t look back in anger, I heard you say/At least not today” – Oasis, Don’t Look Back In Anger

Another song that has taken on new significance for Mancunians in the past two weeks is Oasis’s Don’t Look Back In Anger. Here, it fell to Coldplay to perform it, with a little help from Ariana.

Few bands can get a crowd going like Coldplay, and it was the first of four songs the band played.

As the sun set, thousands of mobile phone lights twinkled during Fix You. Then millions of small multi-coloured stars drifted across the crowd after being shot out of a glitter cannon as Viva La Vida morphed into Something Just Like This.

Live Forever – Liam Gallagher and Chris Martin

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER“Maybe you’re the same as me/We see things they’ll never see/You and I are gonna live forever.” – Oasis, Live Forever

Former Oasis frontman Liam Gallagher was a surprise addition to the line-up, pleasing many of the Mancunian music fans and representing a different side of the musical spectrum to most of the other acts.

And a song that was once all about bravado became melancholy and tender here. That was thanks in part to Chris Martin, again, who filled in for Liam’s brother Noel on acoustic guitar.

We even just about forgave Liam for playing a new song, Wall of Glass.

One Last Time – Ariana Grande

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER

Image copyright DAVE HOGAN FOR ONE LOVE MANCHESTER“So one last time/I need to be the one who takes you home/One more time/I promise after that, I’ll let you go.” – Ariana Grande, One Last Time

Of all of Ariana’s songs, this is the one that fans have turned to since the attack. It was the penultimate song here, which she sang with the rest of the line-up stood behind her.

On the verge of tears, she then went into an incredibly poignant version of Over the Rainbow to close the show.

Her performance throughout the night carried dignified emotion, and she showed grit and willpower by staging this show less than two weeks after those tragic events.

After tonight, she is idolised a little bit more by her fans, is higher in the estimation of those who had thought of her as a pop kitten, and is admired by those who only heard her name for the first time 13 days ago.

The UK plants are located in Wilton (near Newscastle), Severnside (near Bristol) and Cornwall.

The UK plants are located in Wilton (near Newscastle), Severnside (near Bristol) and Cornwall. Jean-Marc Boursier, Group Senior Executive VP in charge of Recycling & Recovery Europe at SUEZ, said: “Waste can become secondary raw materials. Waste that cannot be recycled is also an energy resource with three benefits as it is local, low-carbon and affordable for both local public authorities and industries.

Jean-Marc Boursier, Group Senior Executive VP in charge of Recycling & Recovery Europe at SUEZ, said: “Waste can become secondary raw materials. Waste that cannot be recycled is also an energy resource with three benefits as it is local, low-carbon and affordable for both local public authorities and industries.